Best High-Yield Bonds for Passive Income 2025 you looking for a reliable way to grow your money without constantly watching the market? High-yield bonds for passive income could be the financial solution you’re searching for. In this comprehensive guide, we’ll explore the best-performing high-yield bonds in 2025, compare risks and returns, and provide clear strategies on how to get started as a beginner investor.

What Are High-Yield Bonds?

high-yield bonds, often referred to as “junk bonds,” are corporate debt securities that offer higher interest rates than investment-grade bonds. Why? Because they’re issued by companies with lower credit ratings, making them riskier but more rewarding. If chosen wisely, these bonds can be a consistent source of passive income.

Investopedia defines high-yield bonds as “bonds that are rated below investment grade but offer higher returns to compensate for the increased risk.”

Why Choose High-Yield Bonds for Passive Income?

best High-Yield Bonds for Passive Income in 2025 whether you’re nearing retirement, diversifying your portfolio, or building wealth as a freelancer, high-yield bonds serve as a fixed-income investment that brings regular interest payments.

key benefit

- Higher Returns than savings accounts and government bonds

- Steady Cash Flow through semiannual or quarterly payouts

- Diversification to balance stock market volatility

- Accessibility via ETFs and bond mutual funds

Top High-Yield Bonds to Watch in 2025

Here are some high-performing high-yield bonds making waves this year, according to recent data from Morningstar, Moody’s, and MarketWatch:

1. Ford Motor Company 6.5% Bonds (2029 Maturity)

- Yield: ~6.9%

- Credit Rating: BB+

- Why It’s Attractive: A globally recognized brand with improving balance sheets and strong earnings.

2. Occidental Petroleum 7.1% Bonds (2030)

- Yield: 7.3%

- Credit Rating: BB

- Why It’s Attractive: Oil prices are stabilizing, and the company is reducing debt.

3. iShares iBoxx $ High Yield Corporate Bond ETF (HYG)

- Yield: ~5.6% (variable)

- Why It’s Attractive: A diversified basket of high-yield bonds that reduces individual issuer risk.

Pro Tip: ETFs like HYG and JNK are great for new investors who want passive exposure to high-yield markets.

Risks of High-Yield Bonds: What to Watch Out For

1. Credit Risk

The biggest risk is the issuer defaulting. Always check the credit rating (BB and below = high yield).

2. Interest Rate Risk

When interest rates rise, bond prices fall. Lock in rates when they are favorable.

3. Inflation Risk

Inflation erodes the real return on fixed income.

4. Liquidity Risk

Selling some bonds quickly without affecting the price can be tough.

Learn more about managing financial risk in our post on crypto wallets for beginners.

How to Invest in High-Yield Bonds as a Beginner

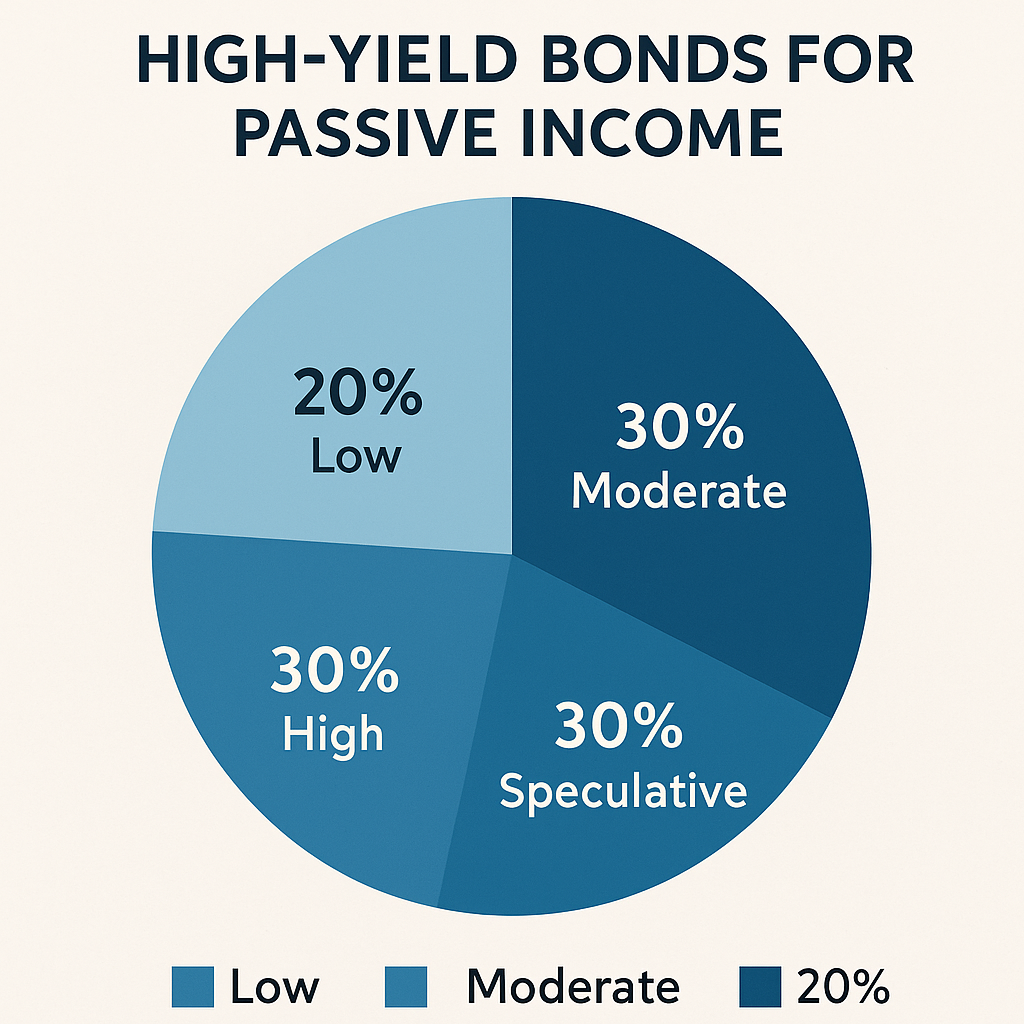

There are multiple ways to enter the high-yield bond market. The best strategy depends on your risk appetite, capital, and financial goals.

Direct Bond Purchase (via Broker)

- Requires minimum capital (usually $1,000+ per bond)

- best for experience investor

Bond Mutual Funds

- Great for beginners

- Instant diversification

- Professionally managed by fund managers, reducing the need for hands-on investment knowledge

Robo advisors

- Platforms like Betterment or Wealthfront now include bond-heavy portfol

- Offer automatic rebalancing, goal-based investing, and low fees — ideal for hands-off investors

Personal Insights: My Passive Income Journey with Bonds

As a freelancer in my early 30s, I was tired of inconsistent income. I began allocating 10% of my monthly revenue to high-yield ETFs. Within 18 months, I started receiving quarterly payouts that covered minor expenses like utility bills. It felt like winning free money—except I earned it by being financially smart.

This experience showed me the value of compound income, something many overlook while chasing fast profits.

Expert Tips for Successful Bond Investing

Don’t Chase the Highest Yield

Sometimes higher yield = higher risk. Look for a balanced risk-to-return ratio.

Reinvest Your Interest Payments

Use a DRIP (Dividend Reinvestment Plan) to build compounding growth.

Monitor Credit Ratings Regularly

Stay updated via Moody’s, S&P Global, or your brokerage.

Sample Bond Portfolio (Low–Medium Risk)

| Asset | Type | Yield | Rating | Allocation |

|---|---|---|---|---|

| Ford 2029 Bond | Corporate | 6.9% | BB+ | 30% |

| HYG ETF | Fund | 5.6% | Varies | 40% |

| Government Bonds | Safe Reserve | 4.1% | AAA | 30% |

Final Thoughts: Is Passive Income from Bonds Worth It?

Absolutely—if done wisely. High-yield bonds can be your silent money machine, working even while you sleep. The key is education, discipline, and diversification.

If you found this guide helpful, share it with a friend, leave a comment, or check out our crypto wallets for beginners and personal finance tools for freelancers. For exclusive updates, subscribe to our newsletter and stay ahead in 2025’s financial game!